Texas Car Sales Tax . Find out who is responsible for. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). texas has a statewide sales tax of 6.25% that applies to all car sales. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. learn how to title, transfer and dispose of a vehicle in texas. Find out how to avoid liability for tickets and tolls after. According to the texas department of motor vehicles, any person that buys a car in texas owes the. The average tax on car sales including.

from downloadbillofsale.com

Find out who is responsible for. learn how to title, transfer and dispose of a vehicle in texas. The average tax on car sales including. According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. texas has a statewide sales tax of 6.25% that applies to all car sales. Find out how to avoid liability for tickets and tolls after. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv).

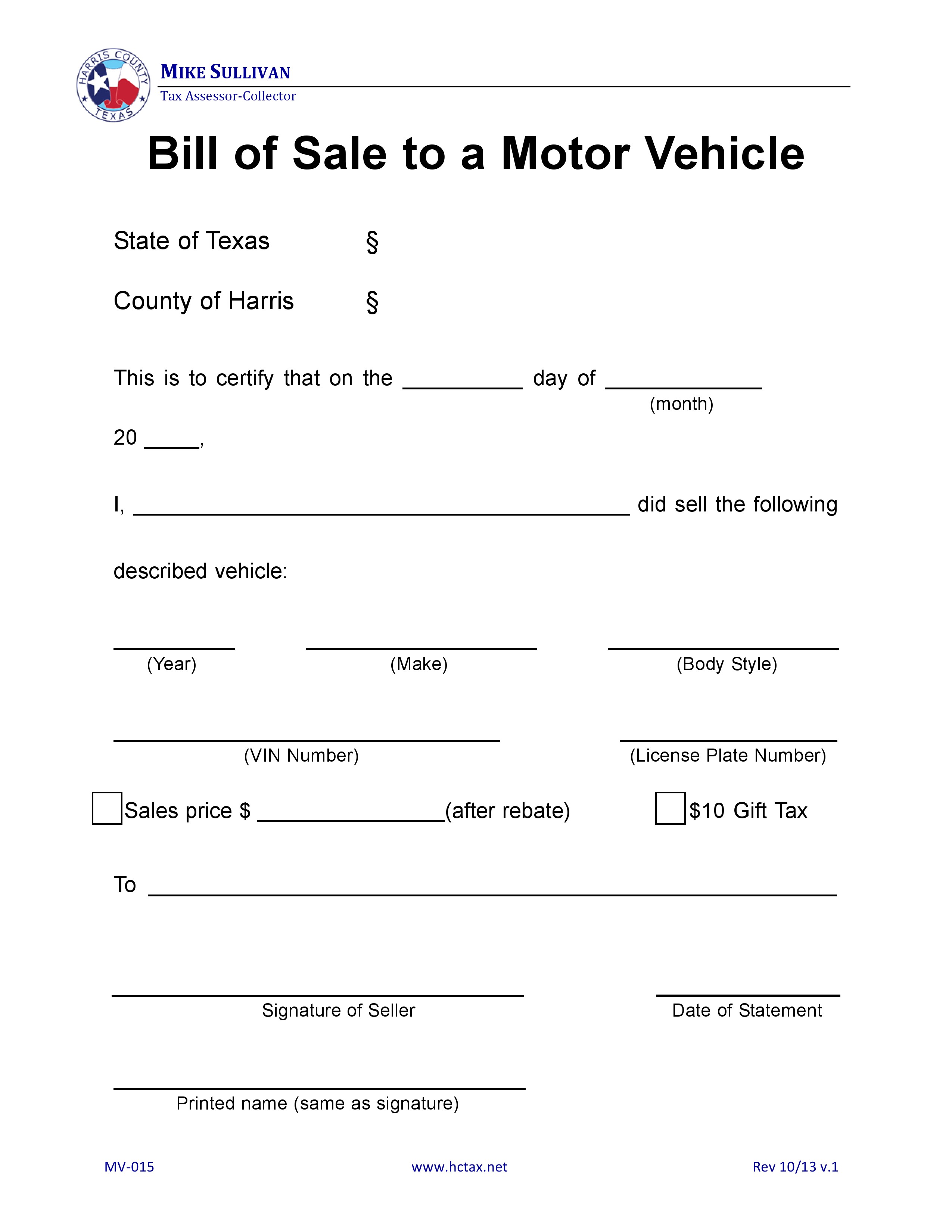

Free Harris County, Texas Motor Vehicle Bill of Sale MV015 PDF DOCX

Texas Car Sales Tax learn how to title, transfer and dispose of a vehicle in texas. According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. Find out who is responsible for. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. The average tax on car sales including. texas has a statewide sales tax of 6.25% that applies to all car sales. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). Find out how to avoid liability for tickets and tolls after. learn how to title, transfer and dispose of a vehicle in texas.

From privateauto.com

How Much Are Used Car Sales Taxes in Texas? Texas Car Sales Tax texas has a statewide sales tax of 6.25% that applies to all car sales. The average tax on car sales including. learn how to title, transfer and dispose of a vehicle in texas. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. Find out who. Texas Car Sales Tax.

From www.strashny.com

State and Local Sales Tax Rates, Midyear 2021 Laura Strashny Texas Car Sales Tax learn how to title, transfer and dispose of a vehicle in texas. According to the texas department of motor vehicles, any person that buys a car in texas owes the. Find out how to avoid liability for tickets and tolls after. texas has a statewide sales tax of 6.25% that applies to all car sales. learn how. Texas Car Sales Tax.

From www.pdffiller.com

How To Texas Vehicle Transfer Fill Online, Printable, Fillable, Blank Texas Car Sales Tax According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). texas has a statewide sales tax of 6.25% that applies to all car sales. learn about the current. Texas Car Sales Tax.

From www.texhas.com

TexHAs Products, Texas Style Texas Resale Certificate Texas Car Sales Tax learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). The average tax on car sales including. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. learn about the current and historical tax rates. Texas Car Sales Tax.

From printablemapaz.com

State And Local Sales Tax Rates Midyear 2013 Tax Foundation Texas Texas Car Sales Tax Find out how to avoid liability for tickets and tolls after. The average tax on car sales including. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. According to the texas department of motor vehicles, any person that buys a car in texas owes the. Find out. Texas Car Sales Tax.

From fill.io

Fill Free fillable Texas Department of Motor Vehicles PDF forms Texas Car Sales Tax learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. Find out who is responsible for. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). learn how to title, transfer and dispose of a. Texas Car Sales Tax.

From seequalls.blogspot.com

sales tax on cars in san antonio texas See Qualls Texas Car Sales Tax The average tax on car sales including. Find out who is responsible for. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn how to calculate the motor. Texas Car Sales Tax.

From mungfali.com

Texas Vehicle Bill Of Sale Form Texas Car Sales Tax learn how to title, transfer and dispose of a vehicle in texas. Find out who is responsible for. According to the texas department of motor vehicles, any person that buys a car in texas owes the. Find out how to avoid liability for tickets and tolls after. learn about the current and historical tax rates for motor vehicles. Texas Car Sales Tax.

From laperlesofourlinves.blogspot.com

sales tax on leased cars in texas Wava Mackey Texas Car Sales Tax The average tax on car sales including. Find out who is responsible for. learn how to title, transfer and dispose of a vehicle in texas. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). learn how to calculate the state and local sales tax on. Texas Car Sales Tax.

From www.carsalerental.com

How To Figure Sales Tax On A Car Car Sale and Rentals Texas Car Sales Tax The average tax on car sales including. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn how to title, transfer and dispose of a vehicle in texas.. Texas Car Sales Tax.

From www.zrivo.com

Texas Car Sales Tax Texas Car Sales Tax Find out how to avoid liability for tickets and tolls after. texas has a statewide sales tax of 6.25% that applies to all car sales. According to the texas department of motor vehicles, any person that buys a car in texas owes the. The average tax on car sales including. learn how to title, transfer and dispose of. Texas Car Sales Tax.

From www.way.com

Everything's Bigger in Texas, Including Car Sales Tax Texas Car Sales Tax Find out how to avoid liability for tickets and tolls after. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. Find out who is responsible for. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value. Texas Car Sales Tax.

From privateauto.com

How Much are Used Car Sales Taxes in Florida? Texas Car Sales Tax According to the texas department of motor vehicles, any person that buys a car in texas owes the. learn how to title, transfer and dispose of a vehicle in texas. Find out who is responsible for. Find out how to avoid liability for tickets and tolls after. The average tax on car sales including. learn how to calculate. Texas Car Sales Tax.

From www.caranddriver.com

Texas Car Sales Tax Everything You Need to Know Texas Car Sales Tax learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. texas has a statewide sales tax of 6.25% that applies to all car sales. learn how to calculate the state and local sales tax on vehicles in texas, as well as other fees and exemptions. Find. Texas Car Sales Tax.

From casiemartins.blogspot.com

sales tax on leased cars in texas Casie Martins Texas Car Sales Tax learn how to title, transfer and dispose of a vehicle in texas. learn about the current and historical tax rates for motor vehicles in texas, as well as the regulations and procedures for. According to the texas department of motor vehicles, any person that buys a car in texas owes the. The average tax on car sales including.. Texas Car Sales Tax.

From www.templateroller.com

Form 14313 Fill Out, Sign Online and Download Fillable PDF, Texas Texas Car Sales Tax According to the texas department of motor vehicles, any person that buys a car in texas owes the. The average tax on car sales including. texas has a statewide sales tax of 6.25% that applies to all car sales. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive. Texas Car Sales Tax.

From lookandstylemagazine.blogspot.com

Selling A Car In Texas With An Out Of State Title / How To Fill Out A Texas Car Sales Tax The average tax on car sales including. Find out who is responsible for. learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). Find out how to avoid liability for tickets and tolls after. learn about the current and historical tax rates for motor vehicles in texas,. Texas Car Sales Tax.

From www.datapandas.org

Car Sales Tax By State 2024 Texas Car Sales Tax learn how to calculate the motor vehicle sales tax of 6.25 percent on the purchase price or standard presumptive value (spv). Find out who is responsible for. Find out how to avoid liability for tickets and tolls after. The average tax on car sales including. texas has a statewide sales tax of 6.25% that applies to all car. Texas Car Sales Tax.